Can You Confidently answer these

pre-retirement questions?

$1 Million may sound like a lot of money to retire with, but consider these factors:

Have you created a written financial plan that includes an income model that adjusts for inflation and tax increases over time?

What is the right age to take social security?

Does your budget include both overhead expenses and desired lifestyle expenses?

Is your portfolio too aggressive or too conservative for your retirement?

Are you 100% sure that you will not run out of money during the

retirement phase of your life?

So many questions... Let's get some answers.

How We Do It:

Financial Advice, Guidance, & Education

Our Income for Life strategy is designed to help you avoid running out of money by providing a reliable income stream tailored to your needs.

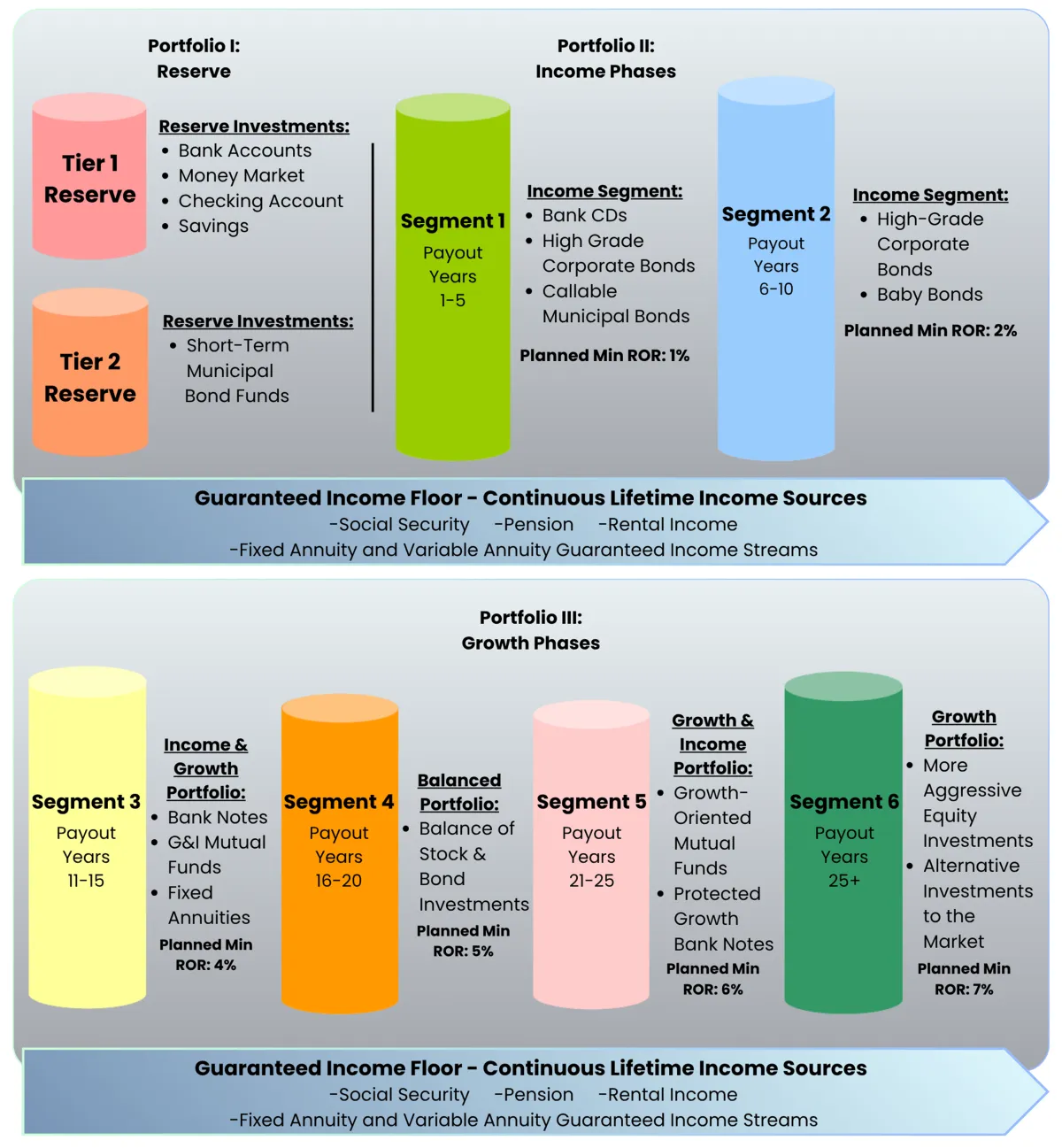

Income distribution planning requires a nuanced approach to position your assets to generate steady, sustainable income over time. Unlike accumulation-phase strategies, the Income for Life strategy employs a time-segmented, inflation-adjusted model, balancing investment choices across varying levels of risk and growth potential.

Your retirement assets are divided into segments, starting with a foundational Guaranteed Income, which is intended to provide immediate, regular income.

Other segments are structured to grow over time and are strategically accessed later to help maintain your income stream.

The final segment can be allocated for legacy planning or extended retirement needs, with the goal of addressing your income requirements throughout retirement.

Do you Have it? We Provide It.

PLEASE COMPLETE THE FOLLOWING QUESTIONNAIRE

This quick questionnaire helps us discover your retirement risk score so that

we can construct a portfolio specific to your needs.

We do not share this information.

FAQs

How We Help You Plan, Invest, and Retire with Confidence Through Personalized Financial Strategies

How does Full Spectrum Financial Solutions personalize its financial planning services?

As Certified Financial Planner® professionals, Full Spectrum Financial Solutions create a comprehensive, customized financial plan that is unique to the client's stage of life. We do this by incorporating a comprehensive approach across the 6 key areas of financial planning specific to an individual's goals and financial resources.

What is your approach to Wealth Management?

Though we work with individuals pre and post retirement, our speciality lies in income distribution models during retirement.

What kind of support can I expect regarding tax planning?

Tax planning is one of the six key areas that we address as it pertains to investing as well as income distributions during retirement.

How do you ensure my retirement planning is secure?

We help to ensure our clients retirement planning by diversifying the portfolio across different money manager styles, utilizing fixed investments to offset the volatility of equity investments, and apply time segmentations to when a client needs their money.

*The Income for life time-segmented distribution strategy should not be construed as a recommendation of the investment plan for all investors. There is no guarantee that any or all segments will obtain their desired results. If desired returns are not met in any investment segment this could cause the investor to run out of income before the end of that income segment. To continue drawing income the investor may have to remove funds from other investment segments before scheduled. This action could lead to additional fees and ultimately the failure of the plan to meet the original objectives. Investors may have to adjust their income amounts to compensate for any investment segment not meeting its goal in order for the actual cash value to last the duration of that income segment. Past performance is no guarantee of future results. Talk to your financial advisor before making any investing decisions.

Check the background of your financial professional on FINRA's BrokerCheck.

Copyright 2025 FMG Suite | Copyright 2025 Commonwealth Financial Network | Copyright 2025 Full Spectrum Financial Solutions

Full Spectrum Financial Solutions, 500 North Broadway, Suite 251, Jericho NY 11753 | P 516-719-0150

The Financial Advisor(s) associated with this website may discuss and/or transact business only with residents of the states in which they are properly registered or licensed. No offers may be made or accepted from any resident of any other state. Please check Broker Check for a list of current registrations.

Securities and advisory services offered through Commonwealth Financial Network®, Member FINRA/SIPC, a Registered Investment Adviser.

Information presented on this site is for informational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any product or security. Investments involve risk and unless otherwise stated, are not guaranteed.

Form CRS: Client Relationship Summary

Use of Cookies: Our website uses Google Analytics to provide insight into our website and to improve the relevance of marketing. For more details about how Google uses information from sites or apps that use our services, visit google.com/policies/privacy/partners/. If you would like to opt out of Google Analytics, please visit tools.google.com/dlpage/gaoptout.

Copyright 2025 FMG Suite | Copyright 2025 Commonwealth Financial Network | Copyright 2025 Full Spectrum Financial Solutions